To purchase a property in Florida, certain legal requirements and procedures must be met. Below are some of the main requirements:

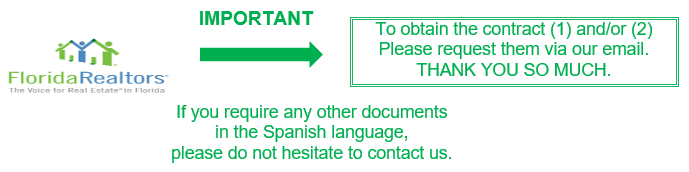

1. Every homebuyer must sign a contract with their representative agent before visiting properties, either in person or

through a virtual tour, to understand exactly what services are being provided and what the compensation for these services will be.

This rule from the National Association of Realtors (NAR), effective as of August 17, 2024, ensures transparency from the beginning of the process.

2. Obtain a mortgage pre-approval: In most cases, a mortgage loan is required to purchase a property in Florida. Before beginning the property search,

it is recommended to obtain a mortgage pre-approval to determine the amount of money that can be borrowed and at what interest rate.

3. Search for a property: Once the mortgage pre-approval has been obtained, the property search can begin. It is important to choose a

property that fits the buyer's needs and budget..

4. Make an offer: Once a suitable property has been found, an offer can be made to the seller. The offer should include details

such as the price, financing terms, closing date, among others..

5. Conduct an inspection: After the offer is accepted, it is recommended to conduct a property inspection to ensure that there are

no major problems that need to be repaired before the purchase..

6. Conduct an appraisal: The financial institution that provides the mortgage loan will conduct an appraisal of the property to

determine its value and ensure that it is in good condition.

7. Sign the purchase contract: Once the inspection, appraisal, and necessary permits have been obtained, the purchase contract can be signed.

8. Make the down payment: The buyer must make a down payment of at least 3% of the sale price of the property, or the percentage required by the financial institution.

9. Close the transaction: Finally, the transaction is closed, where the final documents are completed, payments are made, and property titles are transferred.

In addition to these general requirements, it is also important to consider other factors such as taxes and specific regulations in the state of Florida that may vary

depending on the location of the property. Therefore, it is recommended to work with a real estate agent to ensure compliance with all legal requirements and to conduct

a successful transaction.